New Fire Station Art

The art component of the new Cary Street Fire Station 12 may include art glass of a photo of Oregon Hill Fire Station 6.

This will be heard today at the City’s Planning Commission as well as a “discussion” of the proposed Richmond 300 amendment for Oregon Hill.

A “ladder chandelier “ is proposed for the open tower space, though some were hoping the plans would include an original, antique bell.

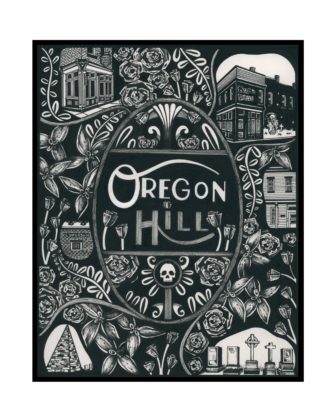

‘Oregon Hill’ print by Jenna Guthrie

Artist Jenna Guthrie has a new “Oregon Hill’ print. It is available for purchase at the Rest In Pieces store or on her website, www.jguthrieworks.com.

New Amphitheater Proposal Threatens Riverfront’s Environment

When I moved to Richmond in the early nineties, it was a much different place. My parents begged me to live outside of the national murder capital, but I was interested in the original, post punk music scene that had emerged here. Midtown Grace Street nightclubs had formed a nucleus where you could walk and see, for a five dollar cover or two, up and coming local and natural bands. Over time, through A.B.C. raids and VCU ‘redevelopment’, this promising scene was split up and done away with. I could lament how big venues with big admission taxes and ticket overages are a poor substitute, but I would be digressing… and I don’t want to live too much in the past…(I do still enjoy walking down to The Camel and local breweries to catch some acts these days).

The other thing that really attracted me to Richmond was how nature was reclaiming space in the city. It was green everywhere- with trees growing on the roofs of abandoned warehouses and just about everywhere else. The formerly industrial riverfront was a highway for all sorts of creatures that were recovering from a history of pollution. Birds were coming back, including migratory birds like purple martins. With a little bravery, folks were swimming with the fish in the James River again. It was beautiful to explore and play in these places, land that time had forgot, at least for a while.

Oregon Hill, with its access to the riverfront, James River Park, and Hollywood Cemetery has been a great neighborhood for nature lovers. In the early nineties, when the City was just about abandoned by white flight, Oregon Hill was almost rustic, with large gaps where old houses had been demolished and VCU had not yet been able to encroach. Deer would come into the alleys via the river, and whole families of possum and raccoon would coexist with humans and their pets. No one expects those conditions to return, at least to that degree.

Of course, the neighborhood welcomed new, sensitive, infill housing, and the Oregon Hill Home Improvement Council worked to ensure that some of it was truly affordable housing. Firework shows and Hollywood Cemetery ceremonial cannon fire would sometimes scare off birds and other wildlife (hopefully we are getting away from those things), but, thankfully, overall nature continued to come back to Belle Island and other parts of the riverfront. Citizens worked with City government to put environmental easements in place. Old trails were brought back to life and more discussion of re-watering the historic canal system came forward. Yes, Brown’s Island and Mayo Island are hosting concerts, but they are somewhat localized to specific areas that were designated for more human activity a while ago. The well-loved Folk Festival and RiverRock as weekend festivals are intrusive but temporary.

Unfortunately, here we are in the 2020’s, and it looks like Richmond is taking a step backward in regard to its environment by insisting on a new amphitheater on its riverfront. A lot of Richmonders don’t get it. The area has already seen so many trees removed, at Monroe Park, at ‘Tredegar Green’, and even in and around the Tredegar Iron Works parking lots. Social activists talk about ‘heat islands’ (which myself and others have been bringing up for decades), but shy away from pointing to perpetuators.

Now, Oregon Hill residents know the grass field where the amphitheater is proposed is not a pristine nature preserve, and never has been (neither is Belle Island, for that matter, which has a history as a prisoner-of-war camp as well as industrial activity before it was a naturalistic park). Right now, these ‘corporate green’ places at least do not get that much regular human activity and animals do use them too. It will be sad to lose the space, period, though we all know ‘the Ethyl fields’ will eventually get developed. But, more importantly, if it is a giant concert facility, pointed directly upriver, it will have a huge impact on birds and wildlife with lots of noise, lights, and human activity. An amphitheater is a particularly harmful use. It will impact Belle Island, Hollywood Cemetery, and James River Park also. These contiguous natural, semi-natural places are very important at that part of the river, especially for migratory birds.

This editorial will probably get ignored and frowned upon by ‘popular opinion’ (that’s alright, I don’t write these things to be popular). The ‘Big Green’ environmental groups are most likely cowed and have no interest in challenging this ‘already zoned’ and ‘ready to build’ project. I don’t expect City Council’s toothless Green Commission or laughable Sustainability Department to do much either. As with the Grace Street music scene, what is organic, truly unique, and ‘grass-roots’ will most likely lose to the corporate power and greed. This is seen as ‘progress’ in Richmond, and I am sure it is as purposeful as Richmond300’s forced land use changes on Oregon Hill. But as with Oregon Hill’s historic streetscapes, once we lose these things, they are likely gone forever.

So what, some say, we want even more large concerts (never mind all the existing and new performance spaces around Richmond, never mind the Coliseum, which is scheduled for demolition) on the river. Some write jealously that its time for Oregon Hill residents to give up ‘their oasis in the city’.

You know what ‘oasis’ means? Although the literal meaning of oasis is “a green spot in the desert,” it can also be used to describe a peaceful area in our everyday lives. It’s obvious they don’t care about peace for Oregon Hill residents or birds and wildlife. (If I sound like a tree-hugger writing that, so be it.). And they still don’t see the big picture.

U.S. and Canadian researchers have repeatedly reported that, since the 1970s, the continent has lost 3 billion birds, nearly 30% of the total, and even common birds such as sparrows and blackbirds are in decline. Despite efforts against pollution, the loss of habitat and overall of human activity continue the decline of birds and wildlife. And while many humans ignore the reality, scientists warn that birds and other creatures are vital for the ecosystem that humans depend upon. In other words, along with climate change, the loss of other species may lead to the eventual extinction of humans too. Of course there are other river areas where there are still birds and wildlife, but natural settings in downtown Richmond, at the falls of the James River, may be especially pivotal in the future of our environment. Perhaps the birds are doomed anyway, as the longterm impact of wifi and 5G are still being argued about even as they are being implemented, but if these and other human factors are impacting birds, can we at least do more to try to make space and refuge for those that are left? Or is building ANOTHER outdoor amphitheater really that necessary?

I will also say this – if Corin Capshaw and his music cohorts think any monetary donations to environmental groups makes this palatable, they are barking up the wrong tree. I would urge him and others to take a long look at who he is doing business with. While Richmond has an infamous ‘business history’ of exporting harm and death (slavery and cigarettes, to name the big ones), the callous NewMarket Corporation comes from a particular lineage that has global reach in environmental poisoning, and has worked tirelessly to cover it up. Regardless, time will tell on them.

New Amphitheater Planned

RichmondBizsense and the Times Dispatch are reporting on plans for a new amphitheater adjacent to the Tredegar Iron Works complex on the downtown riverfront.

While some Oregon Hill residents are excited, other residents are very concerned about its impact on the neighborhood and the riverfront’s wildlife.

Unlike the previous amphitheater proposal, this one is on private land with no special use permit required. The riverfront rezoning over a year ago removes any parking requirement. When City officials presented the rezoning to Oregon Hill Neighborhood Association in Pleasants Park, residents asked to see their master plan, and they replied that they had no plans for the site (which was apparently untrue). They previously removed the trees and the canal raceways and stone sculpture from the site.

With this and Oregon Hill’s Richmond300 amendment going the Planning Commission next week, the neighborhood is on edge and can barely keep up with the pace of change, and that’s probably purposeful under RIchmond’s neoliberal regime.

Trash/Recycling (Might Be) Tomorrow

This Wednesday is a “Red Wednesday”, which hopefully means trash and recycling pickup. I say hopefully, because the Central Virginia Waste Management Authority has struggled to maintain its schedule due to a shortage of workers and has missed some pickups recently and had to reschedule. That said, as neighbors, we should do our best to help.

One tool that might help ameliorate the situation if pickup does not come is this online form:

https://cvwma.com/programs/residential-recycling/recycling-service-request-form/

Please go over what can be recycled. Ideally, rolling recycling containers are stored and deployed in the back alleys along with trash cans. Please make sure you pick up containers after pickup tomorrow night.

If you have not done so already, don’t forget to sign up for your Recycling Perks.

In order to take your recycling to the next level, read this: 10 ways to improve your recycling.

In recycling news, an executive order this spring by Republican Gov. Glenn Youngkin trumpeted efforts to boost recycling, but it also eliminated a commitment by his predecessor to phase out single-use plastics at state agencies and universities.

Click here for Energy News Network story.

Street Cleaning Next Week

Pay attention to the signs and try to warn neighbors, especially those who are out of town…

Foggy Windows

Steamy morning weather is keeping 821 Cafe’s front windows foggy, but it probably smells delicious inside.

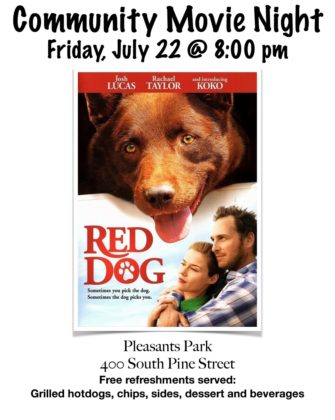

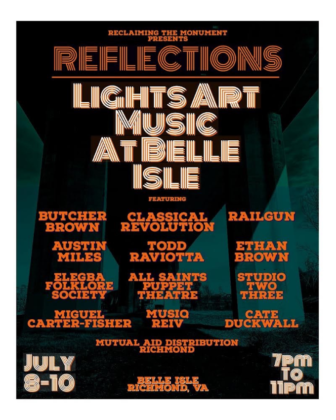

Band and Lights Coming To Belle Island

Showing a total disregard for the birds and nature that rely on Belle Island as a river refuge, this event is scheduled…

Sunflowers On Albemarle